Life Insurance for First Responders and Veteran

The best coverage for your family, at the lowest possible price.

Starting from $1/day

Compare 60+ A-Rated Insurers. All in One Place

Huge savings. 10 minutes approval, day 1 coverage

Term Life

Protecting the people you love

FROM $1/DAY

Whole Life

Compound interest

FROM $3/DAY

Indexed Universal Life

Market gain but never loss

FROM $2/DAY

Annuity

Guaranteed Retirement

Tax-free retirement

Jerry Choate

Crafting Secure Financial Paths

If turning complex financial jargon into understandable strategies was a superpower, I’d be your friendly neighborhood superhero.

At Think Capital insurance, we guide entrepreneurs in creating solid passive income streams through life insurance, financial planning, and retirement services—virtually across the U.S.

In my role as Agency Director at SFG, I partner with a nationwide team to offer bespoke insurance products, powered by our Exclusive Lead System and top-notch technology.

My background spans financial advisory, investment banking, and CFO roles, so I’ve got the expertise—and the jokes—to make financial planning less painful and more profitable.

Soaking up quality time on the beach with my wife, daughter, and our loyal dog. Let’s connect and create a financial plan that’s both fun and rewarding!

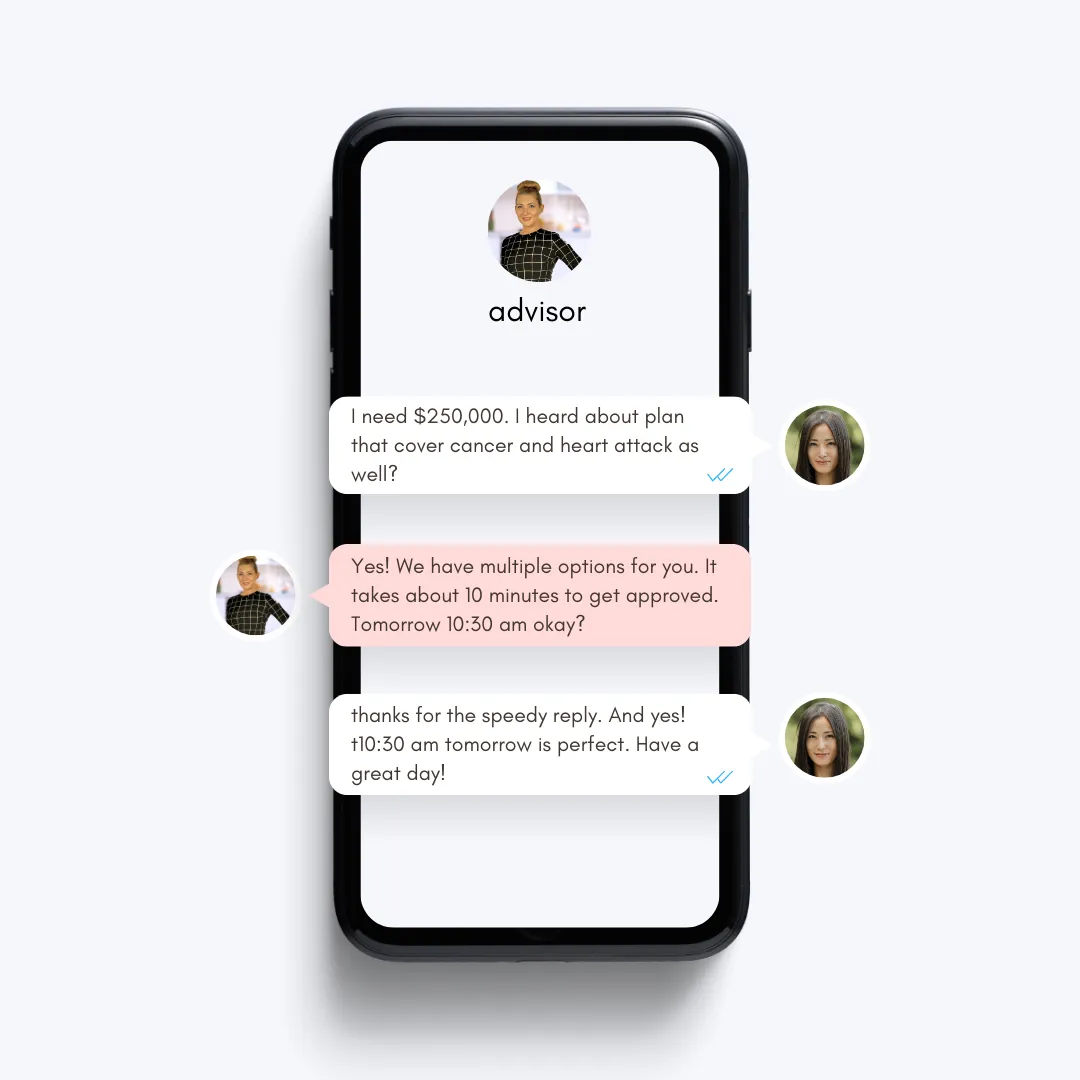

Instant Everything

100% digital when you apply for $2M in coverage or less

Answers to some of your questions

You've got options. We help you find them.

Why Individuals Should Choose Think Capital Insurance?

More options, ensuring a better fit for your needs and budget. Shop all 60 carriers without spending days or weeks searching for the right plan. By providing unbiased advice *since we aren't tied to one company, potentially saving you money by comparing competitive pricing. We tailor coverage to include specific features you need and bring expertise and guidance to help you make informed decisions. We also offer claims assistance, ongoing service to adjust policies as your needs change, and access to specialized products that might not be available through single carriers.

Who can I talk to if I need anything?

You will be assigned a personal advisor. White gloves all the way!

Money back guarantee?

Yes, of course. If, for whatever reason, you’re not completely happy with your policy, cancel in the first 30 days and get a full refund. After that, you can cancel any time without any cancellation fees.

What company are you with?

We are independent broker! Which means we're not tied to any single insurance company. This allows us to work with 6+ top A-rated carriers to find the best policy tailored to your unique needs. Our goal is to provide you with unbiased advice and the most competitive options available in the market.

5 Things you don't know about life insurance

1. There’s more than one type of coverage

2. It has a cash value that grows with compound interest

3. #2 is Tax-free

4. Premiums don’t increase

5. Pay for long term care expenses

A word from Our Clients

Lorem ipsum dolor sit amet, dolor consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam

David Doe

Simple Company

Lorem ipsum dolor sit amet, dolor consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam

David Doe

Simple Company

Lorem ipsum dolor sit amet, dolor consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam

David Doe

Simple Company